Read article as PDF from here: This Is How The Gas Market Opened in Finland

Gasgrid Finland Oy, 17 June 2020

The first decades of natural gas in Finland

Energy use of natural gas in Finland began in January 1974 in the middle of the first oil crisis. The price of crude oil and all petroleum products suddenly doubled or tripled. Construction of the natural gas pipeline from the Soviet Union via Imatra to Kouvola had already begun a couple of years earlier and, despite some challenges along the way, was completed on schedule.

Gas imports had a positive effect on balancing the trade between Finland and the Soviet Union and facilitated the transition of southeast Finnish industry to a combined use of oil and gas and the replacement of coal combustion with the cleaner natural gas. The price of gas was tied to the price of oil for the first ten years, when the oil crises also raised the price of gas high.

An agreement on the import of gas from the Soviet Union was reached for a period of twenty years between the Finnish and Soviet parties. The Soviet Union collapsed before the end of the contract period, but gas remained an industrial fuel and, to a lesser extent, a raw material during the crises.

Over the decades, there were several plans to expand the gas network that had spread to southern Finland: along the west coast, via southwest Finland to Sweden or from Norway via Sweden to Finland and under the Gulf of Finland to Estonia. In the background, there was the idea of bringing gas to Finland not only from Russia but also from the West. The matter was also seen as a security of supply issue, and there were doubts about whether the Soviet Union or later Russia could cut off gas imports to Finland for economic or political reasons. In practice, however, such a situation did not occur in Finland.

But the Finnish natural gas market remained a closed monopoly for 46 years, short of one week. Finland was an EU Member State more than half of that time. Gas came to Finland only from beyond the eastern border, and the same company was responsible for both the transmission and wholesale of gas in Finland. Finland was at the forefront of opening the electricity market, but the last to open the gas market, describes Timo Partanen from the Finnish Energy Authority.

“Since 1997, all electricity users have been able to choose their supplier, but on the gas market, there was only the option of either buying gas or not buying gas until the end of 2019.”

The Natural Gas Directives encouraged to open the market

The European Union has been driving for an internal market in natural gas since the late 1990s, when the first Natural Gas Directive was adopted. At the time, Arto Rajala was secretary of the first working group of the Finnish Natural Gas Market Act at the Ministry of Trade and Industry. Finland was granted certain exceptions to the provisions of the Directive because gas was imported into the country via only one pipeline and there was only one supplier.

“The start of a transitional period for opening the natural gas market was recorded In the Government Proposal for the Natural Gas Market Act. The transitional period lasted about twenty years,” Rajala laughs.

Adopted ten years later (in 2009), the Directive on the Internal Market in Natural Gas describes how the EU continues to work towards real choice for all natural gas consumers, as well as new business opportunities and more cross-border trade. These could achieve efficiency gains, competitive prices and higher standards of service, and contribute to security of supply and sustainability. The effective separation of network activities from supply, production and storage activities is given the most space in the Directive.

Technically, the Finnish infrastructure had shown its reliability over the decades, and the peak years of gas use in Finland were at hand when the 2009 Directive was published. From 2010, a continuous decline of almost a decade began, mainly due to the weakened tax treatment of gas in relation to other energy sources. By the end of the decade, gas use had fallen by half from its peak years.

The Balticconnector project was born

In 2011, Gasum’s management visited the Ministry of Economic Affairs and Employment (MEAE) to present the idea of building an LNG terminal (LNG, liquefied natural gas) on the Gulf of Finland, from which pipelines would be laid to both Estonia and Finland. The Ministry prepared a proposal for the Government, according to which Finland would have applied for funding for the planning and construction of the project from the Projects of Common Interests instrument contained in the EU Energy Infrastructure Regulation.

On 4 February 2011, the European Council outlined that common infrastructure would be developed so that by the end of 2015, no EU country would be an energy island for electricity and natural gas.

The equivalent regulation of the European Parliament and the Council was adopted on 17 April 2013. According to Arto Rajala, the schedule was “plucked out of thin air”, but the policy was important and guaranteed the approval of the highest decision-making body in the EU for the joint Balticconnector pipeline project between Finland and Estonia.

The Energy Union policy adopted by the European Council on 26 June 2014 also had the same effect. Finland was the last gas island with the Baltic countries and now this would come to an end.

Also important at this stage of development was the fact that officials in both MEAE and the European Commission adopted the Balticconnector project in an exceptional way and drove it forward with determination. Several Finnish government ministers went to Brussels to lobby for the project. The cooperation between the then Minister of Economic Affairs Olli Rehn and EU Commissioner Jyrki Katainen was also smooth.

Herkko Plit, Head of Unit at MEAE’s Department of Energy, took over responsibility for fossil fuels at the Ministry from the beginning of 2012. At the time, there was talk of increasing the use of liquefied natural gas, but instead of opening the market, the debate was primarily based on security of supply and the EU Sulphur Directive.

In November 2014, Finnish Prime Minister Alexander Stubb and Estonian Prime Minister Taavi Rõivas had decided that Finland had the first building right to the LNG terminal on the Gulf of Finland and that the right would be transferred to Estonia within a set time limit. The connecting pipeline between the countries would be built together.

Baltic Connector Oy was established in 2015 as a project company to implement the Finnish part of the two-way gas pipeline between Finland and Estonia. The company was established in good cooperation with the Prime Minister’s Office (PMO) and MEAE, and Marko Hyvärinen from PMO became the company’s first Chair of the Board. Quite soon PMO handed over the chairmanship to MEAE, and Plit became the Chair of the Board and later the CEO of Baltic Connector Oy.

Plit believed in the project because good cooperation with the European Commission already existed. The funding decision for design came as early as 4 December 2015. Gasum’s solid expertise in the gas industry was utilised in designing the Balticconnector pipeline before the support decision was received.

In July 2016, the Commission announced that it would grant Baltic Connector Oy and its Estonian partner Elering AS with EUR 187.5 million support from the Connecting Europe Facility (CEF), a total of 75 % of its EUR 250 million budget. In addition to the funding received from the EU, the Finnish State has financed the pipeline with about EUR 30 million.

“On 15 July 2016, I was driving out of the car ferry in the port of Tallinn when the funding decision came, our family’s holiday trip had just begun. The phone started ringing continuously. Even my children sitting in the back seat learned by heart the main points of the project, which I went through with the reporters who approached me,” Plit recalls.

There was interest in the Balticconnector project to the extent that Baltic Connector Oy did not have to advertise vacancies, but many applications were received anyway. Plit describes the initial situation as start-up-minded.

“Tom Främling was the first to be hired to lead the construction project, and we put together a top team to move the project forward,” Plit says. “We stated with Esa Härmälä, who had been elected Chair of the Board, that the money for the pipeline is there, now we also need to ensure that a market is created for it. At the Annual General Meeting of Baltic Connector Oy, Minister of Economic Affairs Mika Lintilä stated that the company should also play a role in preparing for the open gas market. Preparations began vigorously with all parties involved,” Plit continues.

Along the way, both the Balticconnector project and the new Natural Gas Market Act were also critically examined, e.g. in Parliament, which encouraged the Ministry to prepare matters very thoroughly. In Estonia, the pipeline project was taken forward by Elering AS, the operator of electricity and gas transmission networks. The company had acquired the Estonian gas transmission network in 2015.

“Building Balticconnector was a large challenge and faced initial opposition, however, we kept working for the vision and success followed,” describes Taavi Veskimägi, CEO of Elering AS.

The commissioning of the Balticconnector pipeline was celebrated on 11 December 2019. The President of the Finnish Republic, Sauli Niinistö, also took part in the celebration. Completion on time enabled the market to be opened. Many companies had already prepared to participate in the open market in their business plans.

Establishing the market

Preparations for the new Natural Gas Market Act began even before the realisation of the Balticconnector project was certain. Arto Rajala led a working group that comprised the Finnish Energy Authority, the National Emergency Supply Agency, PMO’s government ownership steering, the Ministry of Finance, and the Finnish Competition and Consumer Authority. The Finnish Gas Association, Gasum, Finnish Energy and the Confederation of Finnish Industries were consulted as permanent experts. MEAE commissioned Pöyry (now AFRY) to carry out an extensive study as a basis for the work.

The proposal presented by the working group in January 2016 was that recourse to the exemptions of the Natural Gas Market Directive would be abandoned in about 2020, when the gas market would be fully opened to competition and the transmission network business would be separated from gas sales. New internal market rules would be introduced simultaneously. This with the condition that the Balticconnector pipeline was built – otherwise the market would have been opened considerably less.

The Energy Authority was involved in both the preparation of the Natural Gas Market Act and creating structures for operating in the open market. The Energy Authority is also responsible for monitoring the implementation of the Act.

“The Energy Authority has ex-post control powers over whether, for example, an operator has failed to comply with its obligations under the Natural Gas Market Act or EU legislation. We have little ex-ante control, but when terms are prepared, we ensure that the terms prepared by the transmission system operator are fair and non-discriminatory,” describes Energy Authority’s Expert Buket Yüksel.

The operation of the market is defined at three levels: by legislation, the market terms established by the Energy Authority, and the market rules.

“The broad lines are in legislation, but the practical implementation is in the market rules, some of which have been confirmed by the Energy Authority,” describes Meri-Katriina Pyhäranta from the Energy Authority.

In addition to these, the European Union has adopted network codes, which are directly applicable legislation within the EU.

A reference to the market model was sought from Europe.

“We visited Denmark and Sweden and explored the experiences of Central Europe. Denmark was chosen as a reference. At the same time, we noted that it is important to involve market participants in the work as widely as possible from the beginning, in order to guarantee sufficient transparency and awaken the parties to the requirements of the change,” describes Jouni Haikarainen. Haikarainen, CEO of Lahti Energy as of 22 June 2020, started working as SVP, Natural Gas at Gasum at the end of 2015, and was responsible for opening the market at Gasum and unbundling the transmission business into a separate company.

“The schedule for the market opening was extremely tight, for example in terms of the information systems required,” says Haikarainen.

In November 2016, Haikarainen hired Ville Rahkonen as the development manager responsible for opening the gas market.

Under Rahkonen’s leadership, the development work was carried out in a customer-oriented and participatory manner through open workshops. The workshops were attended by a wide range of market participants, MEAE, the Energy Authority and Baltic Connector. Almost every chapter of the rules had a dedicated workshop. Mika Myötyri, who is Gas Market Specialist at Baltic Connector and contributed actively to the workshops, recalls that there were at least 60 of them.

“There was a positively charged atmosphere in the whole market that something big and revolutionary is being done now. Our small core team had a good spirit that enabled us to progress quickly,” recalls Janne Grönlund, who was COO, Gas Transmission at Gasum at the time.

“At the same time, however, there was a feeling that we must take responsibility for completing this, because there was no other option,” adds Ville Rahkonen.

The new Natural Gas Market Act was approved by the Finnish Parliament on 26 June 2017. The clock to open the market on 1 January 2020 began officially ticking.

Development of the market model was guided by a MEAE-led steering group, which included experts from Gasum’s transmission business, Baltic Connector and the Energy Authority. The idea of setting up the group came from Gasum. Arto Rajala chaired the group. The group’s secretary, Mika Myötyri, calculated that the number of meetings in 2.5 years came to about 30.

“In late summer 2017, an extensive series of workshops was launched to prepare, in dialogue with the sector and market participants, how to trade in natural gas and what rules are needed. The steering group guided the development work, ensuring the creation of a non-discriminatory market model and resolving any differences of opinion,” Rajala describes.

“Rajala guided all actors and cooperation with a gentle but firm hand in the right direction. Competent facilitation was also of great importance. This was the responsibility of Consultant Leena Sivill, who currently works for AFRY,” describes Anni Sarvaranta, who was Development Director at Baltic Connector at the time. The market rules were adopted only six months before the market opened.

The rules created in the process have worked since the market opened, although no one had actual practical experience of how an open market works.

According to Jouni Haikarainen, the interactive workshops significantly increased the participants’ understanding of the specific characteristics of the gas market. Interaction with market participants has become a permanent operating model and will continue in cooperation between Gasgrid Finland and the Energy Authority, and based on the discussion between the parties, the rules can be amended.

“Within the framework provided by legislation and network codes, the rules and terms can be changed to be more appropriate for gas users, if necessary,” says Timo Partanen from the Energy Authority.

The establishment of Gasgrid Finland was preceded by a transitional phase

In its strategy for energy and climate policy in 2016, the Finnish Government outlined the key principles for market opening after the introduction of Balticconnector. The so-called de facto unbundling was prescribed as the unbundling model for the transmission network, with the aim of ensuring the most competitively neutral system operator possible as the market developer. This meant separating the gas transmission business of the state-owned energy company Gasum into a separate state-owned limited company.

In autumn 2018, the State decided that there would be only one transmission system operator in Finland, which would own the entire Finnish high-pressure gas transmission network, including Gasum’s transmission networks and the Balticconnector pipeline.

In order to ensure a smooth transitional period, Suomen Kaasunsiirtopalvelut Oy (Finnish Gas Transmission Services) was established as a subsidiary within Gasum with the task of owning Baltic Connector Oy and all infrastructure, and ensuring a successful transition to an open gas market. Finnish Gas Transmission Services served as a temporary contact surface and communication channel towards the market. In addition, it was responsible for recruiting the CEO of the new transmission system operator and developing the new company’s operations.

From the beginning of 2019, the company was headed by Kai-Petteri Purhonen as Chair of the Board. Purhonen currently serves as Chair of the Board of Gasgrid Finland. Baltic Connector Oy’s market development functions and Anni Sarvaranta and Mika Myötyri, who worked on them, also transferred to Finnish Gas Transmission Services. Sarvaranta and Myötyri ran the company’s day-to-day operations in a start-up spirit in a 20-square-metre office in Otaniemi, Espoo.

“One day we fetched a coffee machine from supermarket Prisma and tendered out the future transmission system operator’s business premises solutions, on another day we developed a common market between four countries at international negotiating tables – that was the life at a state-owned start-up,” describes Sarvaranta, who was COO of Finnish Gas Transmission Services.

Myötyri and Sarvaranta also visited almost every Finnish distribution network operator during spring 2019 and drove the entire Finnish gas network from one end to the other.

“It was a big job, but we got a lot of positive feedback from it. We also visited the biggest customers and the transmission system operators in neighbouring countries with Purhonen,” says Sarvaranta.

“We got information to take to the steering group and rule projects which we would have missed without the roadshow,” Myötyri adds.

In summer 2019, Olli Sipilä was elected to the company’s management, and he would also be appointed as CEO of Gasgrid Finland Oy, to be established on 1 January 2020.

“Even though the company was officially within Gasum, we were actually completely separate. It was easy for customers to approach us with any question,” Sipilä describes.

Sipilä emphasises the role of Chair of the Board Purhonen, who came from outside the energy sector. His thinking had built-in customer orientation, agility and “lean”, which are now being pursued in the energy sector. Sarvaranta and Myötyri also appreciate how Purhonen started to build a common culture for the transmission system operator by frontloading the teambuilding process for people transferring from Gasum and Finnish Gas Transmission Services to the new company already in spring 2019.

At the same time as the new company’s operations were developed in Finnish Gas Transmission Services, Gasum continued to separate its own operations and develop systems and a market model for the open market. Setting up functional information systems on time was one of the biggest challenges of autumn 2019. Janne Grönlund, currently SVP, Transmission Platform and Customers at Gasgrid Finland, remembers how customers conveyed an understanding of the demanding situation.

“This came not just from one or two customers, but more broadly. The parties hoped for the introduction of the systems earlier but saw and understood the situation we were in when creating the IT systems,” Grönlund recalls.

During 2019, three systems were built for the transmission system operator: An energy management system, which performs Finland’s national imbalance settlement, capacity settlement and invoicing. A portal was built on it, which is an interface with the market. Thirdly, a gas data hub was built for the retail market imbalance settlement.

“The IT systems had to be implemented using agile methods because there were so many moving parts. Tiina Niinimäki played an absolutely key role as IT Project Manager,” Rahkonen recalls.

A firewall had been built between Gasum’s transmission business and sales operations from the beginning of 2019. Sensitive market information no longer passed from transmission to sales. However, the management of Finnish Gas Transmission Services and Gasum met regularly until the end of 2019 to ensure the successful opening of the market and the start-up of the new company.

The market opened

Sunday, 29 December 2019, three days to the opening of the gas market.

Ville Rahkonen’s telephone rang. A customer called exceptionally on a Sunday, since they guessed Ville would be on his computer.

“We might as well have enjoyed Christmas chocolates at home, but Anni Nuppunen and I had come to work to test the systems to be introduced at the turn of the year. We solved the customer’s issue and they wished us good luck – it felt like a sincere wish and kept us going to the finish line,” Rahkonen recalls.

The team responsible for opening the market spent New Year’s night at the Kouvola central control room and ensured everything worked as it should. Nor did Gasgrid Finland’s new CEO Olli Sipilä sit quietly at home having a morning coffee when the market opened on 1 January 2020 at 7 am.

“During the night in Kouvola, we set up the new transmission system operator, Gasgrid Finland, to which we merged Gasum’s gas transmission operations, including IT systems. At seven in the morning, we started Balticconnector’s compressor station in Inkoo, and gas began to flow under the Gulf of Finland into Gasgrid’s transmission network. A couple of hours later, I dared to have a cup of coffee in our Kouvola control room,” Sipilä says.

Jouni Haikarainen called Gasum’s Jyväskylä energy control room in the morning and received confirmation that everything was going well.

The Finnish gas market was successfully opened. At the Gasgrid Finland stakeholder meeting at Finlandia Hall on 12 February 2020, Arto Rajala described how several smiling faces had been seen in the Ministry’s corridors in the beginning of the year, because the opening of the market had succeeded beyond expectations.

Customer experiences

Helen Ltd’s Vuosaari CHP plant is one of the largest users of natural gas in Finland. Heat and electricity are produced there from natural gas. Up to a third of total natural gas consumption in Finland occurs there. The company prepared for the opening of the Finnish natural gas market for a long time and believed that the opening would lead to an improvement in the competitiveness of natural gas and thus, above all, affordable district heating for customers.

“With the introduction of the open market model, diversified gas pricing structures have certainly at least accelerated the reflection of market price changes on the gas price level experienced by Finnish gas consumers,” says Lauri Pirvola, Leading Gas Market Specialist at Helen Ltd.

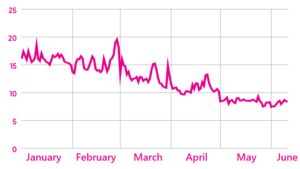

Baltic-Finland gas spot price index for the Finnish market 2020, BGSI FI, EUR/MWh

Overall, Helen’s experiences of opening the market are positive. All the main open market-related entities were introduced on schedule and the market is functioning as planned. There is, of course, room for improvement.

“From time to time, there have been challenges in the flow of information and the equitable sharing of market information in the new market area formed by Estonia, Latvia and Finland, but these issues will be paid more attention in the future,” says Pirvola.

The compressor station in Estonia was not fully completed when the market opened. Thus, when the market opened, Balticconnector’s capacity was not yet sufficient to match the trade that began briskly between market participants.

“In order to ensure the efficient operation of the new market area currently formed by Estonia, Latvia and Finland, it is important to increase Balticconnector’s transmission capacity as quickly as possible close to the designed level,” says Pirvola.

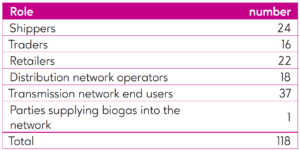

As a single detail, Pirvola now recalls with a smile how the size of the gas market grew by 11% overnight and unit prices fell by the same amount. This was due to the transition to the use of a higher heat value in conjunction with the opening of the market. An irresistible indicator of the success of the opening of the gas market is the number of market operators participating in the open market. There are several parties importing gas through Balticconnector and more than one operator at the Imatra point.

Number of market participants in the Finnish open gas market in 2020

“

“

“

One of the new operators in the Finnish market is JSC Latvijas Gaze, Latvia’s largest natural gas seller. The company started preparing for entering the Finnish market already in 2018. “We followed closely the development of regulation and at the same time, shared open market information among our partners. It seemed clear from the beginning that gas in Balticconnector would flow in the direction of Finland,” says Jānis Kalējs, VP, Wholesale at the company.

Jānis Kalējs describes the first moments of the opening of the market as hectic, but highlights Gasgrid Finland’s approach to market development together with market participants.

“All market participants are listened to, and the company modifies its development strategy based on the feedback received. Fantastic!”

Olli Sipilä also says that he has received positive feedback from customers about cooperation and openness, encouraging to continue with the same operating model in the future.

Gas market integration

S

At the same time as the Finnish market was opened to competition, a common market was developed with Estonia, Latvia and Lithuania.

The transmission system operators of Finland, Estonia and Latvia agreed on the intention to create a common market in October 2018 and finally on tariff-free gas transmission between the countries on Valentine’s Day in 2019.

“We were the last in Europe to open the gas market, but we were among the first to create a common tariff area,” sums up Myötyri, who is currently employed by Gasgrid Finland as Gas Market Specialist.

At the European level, an exceptional agreement has removed the transmission tariff from the borders between the countries and every shipper bringing gas into the common market pays the same tariff, regardless of the entry point. All gas suppliers who buy gas from the border are in an equal position.

“The abolition of cross-border transmission fees promotes gas trade and competition in the region. Discussions are currently taking place on how to involve Lithuania in the agreement. Negotiating such agreements is quite challenging,” says Anni Sarvaranta from Gasgrid Finland, who led the contract negotiations on the Finnish side and is currently SVP, Market Development.

In addition to the tariff zone, Estonia and Latvia have formed a joint balance area. Gasgrid Finland’s goal is also to deepen integration in the region in order to develop the vitality of the gas market. The work is demanding and means large-scale harmonisation of operating models and international agreements, careful study and planning work, and open dialogue with market participants.

“The final vision would be one common European liquid gas market,” says Timo Partanen, who leads the market integration work at the Energy Authority.

“Finland’s and the Baltic countries’ project to integrate regional markets is in line with the EU Gas Directive and the most ambitious of its kind so far,” sums up Arto Rajala, MEAE.

The way forward

The Finnish gas market has opened and the first steps towards regional market integration have been taken. What next? What do some of the experts interviewed for this text think about infrastructure projects, further market integration and the future of gases?

Klaus-Dieter Borchardt, Deputy Director-General, European Commission, Directorate-General Energy (DG ENER):

The EU aims for a well-functioning liquid market that provides security of supply and gas for both consumers and companies at competitive prices. DG ENER also supports the development work of the Finnish and Baltic regional market, which aims to draw maximum benefits from the current infrastructure and that under construction, and to attract more competition to an otherwise small market. The EU’s goal of being carbon neutral in 2050 requires exploiting all possible synergies. The Commission will shortly publish its views on this process in a strategy paper on energy system integration.

Herkko Plit, CEO, Baltic Connector Oy:

The market has been successfully opened. The future challenge is to keep the market operational and utilise gas infrastructure in the energy revolution. The gas network combined with artificial intelligence provides an unused resource for energy storage. The infrastructure investment was made for 50 years, during which time fossil gases will make way for hydrogen or synthetic gases. Solar and wind energy can be converted to hydrogen by electrolysis and further processed into synthetic gas. In this way, John Doe’s solar panels in Finland can bring power to the iPads of a Chinese nursery. Hydrogen will play a major role in the energy field of the future.

Timo Partanen, Leading Expert, Finnish Energy Authority:

I think the goal would be to have one European gas market with one truly liquid exchange. Sectoral integration, where gas, electricity, water, telecommunications and district heating would be different sides of the same coin. Especially electricity, gas and district heating could complement each other. Surplus wind power could be used to make district heating or produce hydrogen from water molecules that would be stored in the gas infrastructure. Hydrogen could be used to make synthetic natural gas with biofuels to replace fossil gas – for the Central European consumer, it is not technically important which is used to warm their house, but it is important for the climate. Balticconnector and the opened regional market are also of interest elsewhere in Europe. Greater European interest will be seen when GIPL and Baltic Pipe are introduced, and the market becomes truly European.

Taavi Veskimägi, CEO, Elering AS:

The future of the European gas market lies in green gases and the reduction of emissions. This requires EU-wide certification of the origin of gases and a supporting digital platform. The gas network, the flexibility it offers, green gases and sectoral integration will help to break away from coal.

Jouni Haikarainen, SVP, Market Risks and Energy Trading, Gasum Oy (as of 22 June 2020, CEO of Lahti Energy Ltd):

The gas market in the Finnish and Baltic transmission network area is small and is not growing due to customers’ carbon-neutrality goals. GIPL will not change this significantly. The opening of the market came at a very exceptional time: the Sino-US trade war and the mild winter caused historically low gas prices, which were passed on to customers with the opening of the market. This development is likely to continue. The integration of gas networks and common balance areas are good goals, but the full benefits would only be reaped if the transmission system operators merged. A disadvantage of the merger would be the compromises on transmission fees.

Jānis Kalējs, Director, Latvijas Gaze:

I look forward to the full capacity of Balticconnector, after which we will see how the market develops. The Inčukalns underground gas storage and development of the related regulation will also have an impact. One of the most important issues is the common balance area of Finland, Estonia and Latvia, which allows us to talk about full market integration, which Lithuania might also be able to join in due course. When completed, GIPL will also provide a physical connection to the Western European market; currently, the price of gas in our area already reflects the indices there. Expansion means both more competition and new opportunities. It is also important to harmonise cross-border tariffs so that different entry and exit tariffs do not accumulate in the price of gas.

Olli Sipilä, CEO, Gasgrid Finland Oy:

The integrated and opened gas infrastructure will be a big opportunity for Finland. It will allow us to move faster, safer and more cost-effectively to carbon neutrality. We can develop export industry around green and synthetic gases. With the help of technologies, we can sequester emissions and store clean electricity as gases, preparing for when there is no wind, sun or rain. Finland can be a pioneer in market-based change. We have a good spirit of cooperation between different sectors and many strong companies to succeed in the megatrend. The open gas market has increased the competitiveness of our customers. Gasgrid Finland’s open and customer-oriented approach has been praised. However, development is at an early stage and much remains to be done to develop regional markets. The competitiveness of gases must now be ensured, and regulations must support the growth of innovations in the sector.

As can be read from the above, opening the gas market has been a big task, even for decades. It shows that persevering and determined work will ultimately lead to results. The future of gases is also in the hands of those who make them.10

The following people were interviewed for the article:

Timo Partanen, Finnish Energy Authority

Meri-Katriina Pyhäranta, Finnish Energy Authority

Buket Yüksel, Finnish Energy Authority

Herkko Plit, Baltic Connector Oy

Arto Rajala, Ministry of Economic Affairs and Employment of Finland

Jānis Kalējs, Latvijas Gaze

Jouni Haikarainen, Gasum Oy

Taavi Veskimägi, Elering AS

Klaus-Dieter Borchardt, European Commission

Lauri Pirvola, Helen Ltd

Olli Sipilä, Gasgrid Finland Oy

Anni Sarvaranta, Gasgrid Finland Oy

Mika Myötyri, Gasgrid Finland Oy

Janne Grönlund, Gasgrid Finland Oy

Ville Rahkonen, Gasgrid Finland Oy

Additional sources include releases and websites of |the European Union, ministries and companies, news media and the work GAS! – Natural Gas and Finland 1974–2004 by Antti Parpola and Veijo Åberg.

Author: Tero Lehtinen / KREAB Oy

Gasgrid Finland Oy is a Finnish state-owned gas transmission system operator with system responsibility. Our task is to ensure safe, cost-efficient and reliable gas transmission for our customers and society. We actively develop our infrastructure, services and the gas market to promote a carbon-neutral energy system of the future. Read more: www.gasgrid.fi/en