The end of the gas year 2022-2023 is approaching and, at the turn of the year the open gas market in Finland will have functioned for four years. These four years have seen market events from one extreme to the other and the functioning of the gas market has been tested during the short history of the open market. This review focuses on events during the current gas year and the outlook for the upcoming winter.

Gas year 2022-2023

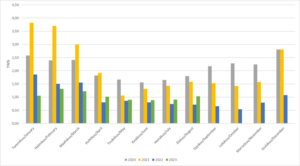

Before last winter, the outlook on the energy markets was concerning, and the news spotlight was on energy sufficiency. Before winter, Gasgrid Finland held customer events for market participants to review, in particular, the early warning level under the Security of Supply Regulation as well as the alert and emergency approaches and the responsibilities of each market participant, authority and TSO with system responsibility. At around just 0.5 TWh, gas use was particularly low at the start of the current gas year and 3-5 times lower compared to two previous years. The fallout of Russia’s invasion in Ukraine could be seen in gas users’ and market participants’ preparedness in the approaching winter amid an energy crisis. The price level of gas energy during these times was exceptionally high and the price index in the Finnish market area was around €200/MWh, which naturally decreased gas usage.

The Hamina LNG terminal was connected to the Finnish gas transmission system at the beginning of October 2022, providing an alternative gas import route to Balticconnector, had previously been the only import route for several months. At the same time, the technical and commercial operations of the Inkoo LNG floating terminal were in a very intensive phase with the goal to connect the terminal to the Finnish gas system to an extremely tight schedule by the turn of the year. This was successfully achieved, and the terminal ensured Finland’s security of supply on a number of occasions during winter 2022-2023.

The coldest winter days were seen in February-March 2023. At the same time, the price level of gas energy had already been steadily decreasing as the European gas market heaved a sigh of relief due to a mild winter, which kept European gas stocks at a better level than feared earlier. Balticconnector served as the main import route during winter. With regard to capacities booked by terminal users and daily gasification, Inkoo LNG floating terminal began normal commercial operations in April and so during winter the terminal served primarily to ensure security of supply. During the coldest winter spells, Balticconnector was congested and on some days demand for gas clearly exceeded import capacity.

As the TSO with system responsibility, Gasgrid Finland is responsible for the physical and commercial balancing of Finland’s gas system. The end of transmission via Imatra and two new LNG terminals significantly changed the balancing operating environment of Finland’s gas system and the means of the TSO with system responsibility to ensure balancing decreased. The need for balancing control activities increased and the gas system was more vulnerable than earlier to be directed to critical levels due to less flexibility. During the gas year, this has been seen in noticeably more dynamic balancing control, whereas Gasgrid Finland, as the TSO with system responsibility, has on some occasions had to take dramatic balancing control measures to maintain balance in the gas system. Particularly sensitive situations from a balancing perspective were winter days when gas use was at the same level as import capacity. A couple of times, gas use was even greater than the entry capacity offered to the market, but dramatic balancing control measures and the flexibility afforded by line-pack helped to overcome the situations and security of supply for gas users was ensured throughout winter.

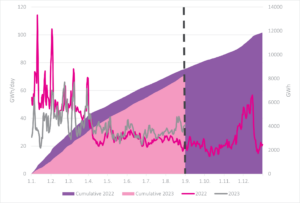

April saw a start in earnest of commercial operations of the Inkoo LNG floating terminal and gas entering through the terminal covered some of the gas demand in Finland and the Baltics and significant quantities of gas was transmitted to the Inčukalns gas storage facility in Latvia. The Inkoo LNG terminal has injected gas continually into Finland’s gas network for approximately six months. During this time, around 10 TWh of gas has been transmitted from the terminal. Since April, the gas flow in Balticconnector has mostly been from Finland to Estonia due to market participants’ significant transmission needs southbound from the LNG terminal. Despite the direction of the gas flow mainly being towards the south, market participants have transmitted gas commercially from Estonia to Finland on a daily basis. Since Balticconnector is a bi-directional pipeline connection, Gasgrid Finland receives nominations or requests from market participants for gas transmissions in both directions. The physical direction of the gas flow is determined when the nominations made in both directions are taken into account and added together. In other words, gas transmission nominations in Balticconnector have been greater in the southern than in the northern direction.

The summer of 2023 was exceptional in that Balticconnector was not available to market participants for more than a month due to pipeline maintenance work carried out in the Baltic gas transmission system. During this time, the Finnish gas market again found itself in a new situation when gas use in Finland was covered by the LNG terminals in Inkoo and Hamina. This was again a great effort for market participants as a major import route was completely unavailable and gas supplies to customers had to be covered using alternative solutions. The gas market functioned well during this time despite very limited liquidity in the Finnish market, which in turn hampered balancing between market participants and responding to any rapid changes in gas demand. The time was also very challenging for Gasgrid Finland from a balancing aspect since flexibility elements were more limited than before. Balticconnector was back in use after July and capacity was more than sufficient compared to market demand.

An examination at a monthly level shows that from April 2023 onwards gas use has been greater compared to the corresponding period a year earlier. Particularly in August, gas use was well above the previous year’s level (>40%). August and September at times saw high electricity prices especially when annual nuclear power plant maintenance outages coincided with restrictions on transmission links between countries and quiet weather conditions. This was reflected at times as increased use of gas when gas was used for electricity production needs. During August-September, the baseload of Finnish gas consumption, mainly consisting of industrial use, settled at a level of 30 GWh/day.

Mid-September outlook for the winter ahead

During September 2023, Gasgrid Finland’s transmission business unit already turned its sights to the winter ahead even though temperatures still rise to summer levels. The biggest changes in the outlook for the winter ahead compared to the previous one are the commercial readiness of the Inkoo LNG entry point with its capacity of around 140 GWh/day and a considerably lower gas energy price level. In the winter season 22/23, gas energy price index in the Finnish market area was around €95/MWh, while the winter futures on the Western European markets predict a price level slightly above €50/MWh.

During this gas year, the Inčukalns gas storage facility has been filled significantly higher than in the previous year due to the large price difference between summer and winter, and the improved regional capacity situation. In mid-September, the Inčukalns gas storage facility was filled to a rate approaching 90% full compared to a maximum of 60% in mid-November 2022. The overall situation of European gas stocks is currently much better than the previous winter as in the situation prevailing in mid-September, EU gas stocks averaged 95% full.

The high stock level of the Inčukalns gas storage facility indicates that market participants will transmit the gas they have stored to meet the needs of end-users in the winter season ahead. In Finland’s case, this would mean a remarkable utilisation rate of Balticconnector capacity. The LNG terminals in Hamina and Inkoo provide alternative import routes. The Hamina LNG terminal has an annual capacity booking process underway for the upcoming gas year. The Hamina LNG entry point has a capacity of 6 GWh/day. Entry from the Inkoo LNG floating terminal into Finland’s gas network will be from the start of the gas year until the second half of November – albeit before mid-October, daily gasification volumes will be very modest (20-30 GWh/day) compared to the technical capacity of the Inkoo LNG entry point due to maintenance works carried out in Latvia and Estonia. Floating LNG Terminal Finland regularly updates its gasification schedule. The current view shows that the terminal’s capacity has not been booked for the winter season. However, spot slots can still be booked, so the situation may yet change in this respect.

Mandatory maintenance work will be carried out in Estonia and Latvia during October-November and this will significantly reduce Balticconnector capacity from Estonia to Finland and cut capacity fully from Finland to Estonia, An up-to-date gasification schedule for the Inkoo LNG terminal can be found here, the regional maintenance plan here and up-to-date capacity data here.

The transmission capacity between Latvia and Lithuania has increased to a level of 90 GWh/day. On completion, the ELLI (Enhancement of Latvia-Lithuania Interconnection) project will improve the capability of the Baltic transmission system to transmit gas to the north, which will have the effect of increasing capacity in the Balticconnector. The current view is that the project should complete by the turn of the year, but market participators will be informed of this as soon as clarity regarding the schedule has been obtained from the Lithuanian and Latvian TSOs. The TSOs will communicate matters related to capacity via the UMM platform.

Gasgrid and Elering are making updates to the terms and conditions of the Balticconnector capacity allocation mechanism. The primary aim of the TSOs is to develop a model so that the commercial mechanism enables the efficient use of technical capacity in situations where there are nominations in both directions in a bi-directional pipeline, for example, where market participants on the same gas day need to transmit gas from the LNG terminal in Inkoo and/or Hamina to the south and from the gas storage in Latvia to the north. The TSOs had discussions with the regulatory authorities in late September and the plan is launch consultations in October. There is a similar schedule regarding updating balancing terms and conditions and likewise in this respect market participants will be consulted in October.

For further information, please contact Mika Myötyri, Head of Market and Customers: mika.myotyri@gasgrid.fi